Meet FinanceCo, a rapidly growing investment management firm with over $150M in assets under management. They were scaling quickly, onboarding new clients, and expanding their investment portfolios—but they were stuck with outdated legacy systems that couldn’t keep up with the demands of modern compliance.

Their manual processes for AML (Anti-Money Laundering) and KYC (Know Your Customer) were slow, prone to errors, and, frankly, a ticking time bomb. In a world of ever-tightening regulations, the pressure was on to get things right—quickly.

As the company grew, managing risk and following local and international financial rules became more complicated. The team spent a lot of time dealing with compliance audits and going through heaps of paperwork to show they were following the rules. Worst of all, their old systems made them more likely to face fraud, and they were at risk of serious penalties for not staying compliant.

A Solution Built for the Future:

Our custom-built compliance and risk management solution

FinanceCo needed a solution that could do more than just check boxes on compliance forms. They needed a modern, automated system that would streamline processes, reduce risk, and—most importantly—future-proof their operations.

That’s when they turned to Cloud Convoy, Our compliance and risk management solution solution designed to automate everything from customer onboarding to transaction monitoring, while also fortifying cybersecurity.

Here’s what we implemented:

1. Automated KYC & AML Checks: No more manual data entry or paper-based verification. We connected FinanceCo to a global network of regulatory databases, ensuring every client was vetted and approved instantly.

2. Real-Time Risk Assessment: Instead of waiting for a monthly report or a manual review, FinanceCo could now monitor transactions in real-time, flagging suspicious activity automatically.

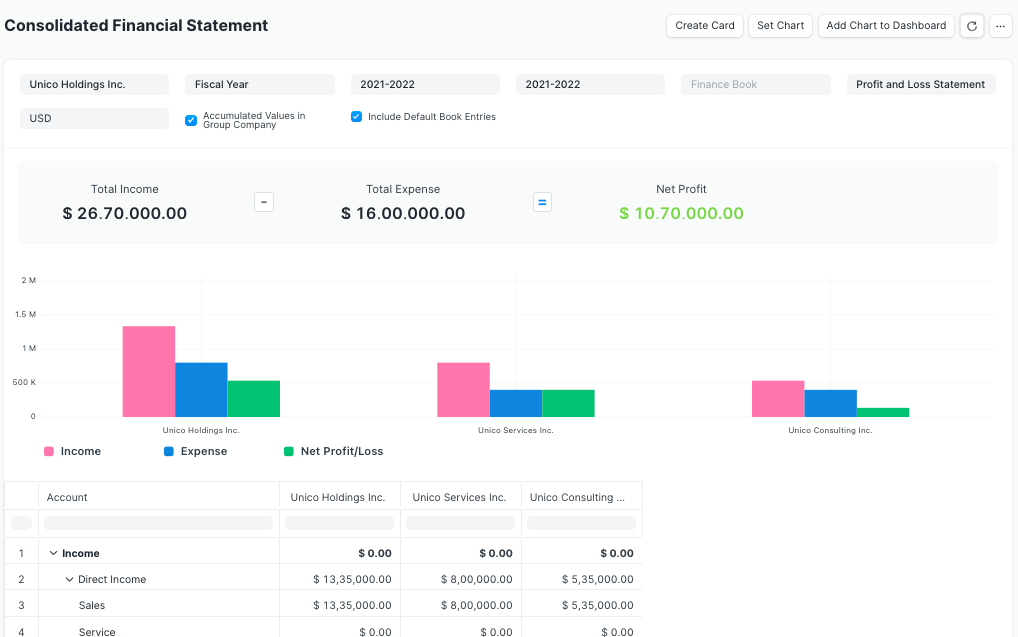

3. Regulatory Reporting On-Demand:

We set up a fully automated reporting system that generated compliance documents, audit-ready, in seconds—tailored to both local and international regulations.

4. Cybersecurity Shield:

We added a robust layer of encryption and fraud detection, making sure customer data was safe, and fraudsters had no place to hide.

The Results?

With our Software Solution, the transformation was nothing short of remarkable.

Let’s break it down:

1. Efficiency Boost

Before us, the team spent 200+ hours each month manually processing KYC/AML checks. Now? That time has dropped to just 40 hours per month—an 80% reduction in manual effort. This freed up their team to focus on strategic growth rather than compliance firefighting.

2. Audit Relief

FinanceCo’s compliance team used to dread audit season. Reports were disorganized, and it often took weeks to pull everything together. Now, with automated reporting, they can produce audit-ready documents in under a week, saving over 3 weeks of prep time every single audit cycle.

Cybersecurity:

In the Financial Services Industry, security is paramount. After the integration with out Software Solution, FinanceCo saw zero data breaches—a huge improvement from the minor incidents they had experienced annually before. Fraudulent transactions were flagged 50% earlier, saving the company $300K a year in potential losses.

Cost Savings That Add Up:

With all the automation, FinanceCo saved $150K annually in labor costs alone. Add to that the $500K they avoided in potential regulatory fines due to better compliance practices, and you have a clear win. Overall, operational efficiency improvements saved the company an estimated $200K annually.

Scalability for Growth:

One of the biggest advantages of our Software Solution is its ability to scale seamlessly. FinanceCo was able to onboard 30% more clients without increasing costs or requiring additional resources. The system adapted to their growing needs effortlessly.

The Bigger Picture

It’s a Highly advanced All-in-One software solution that empowers financial institutions to meet the ever-growing demands of compliance and risk management.

Whether you’re an investment firm, microfinance institution, or any other financial entity, Our solution is designed to save you time, reduce risk, and improve overall efficiency.

In an industry where regulatory requirements are constantly evolving and cyber threats are a constant concern, Our Software Solution ensures that your institution is always one step ahead.

The ability to automate compliance checks, securely monitor transactions, and generate reports on-demand means you can focus on growing your business, knowing your operations are secure and compliant.

Can Cloud Convoy Your Institution?

If you’re facing similar challenges—outdated systems, compliance headaches, and security concerns—We can built a custom software solution that solves you need. Our team works closely with financial institutions to tailor solutions that meet specific needs, from AML and KYC automation to enhanced cybersecurity.

Want to learn more?

Schedule a quick consultation to see how we can help transform your Financial Institution and ensure you stay ahead of compliance challenges.